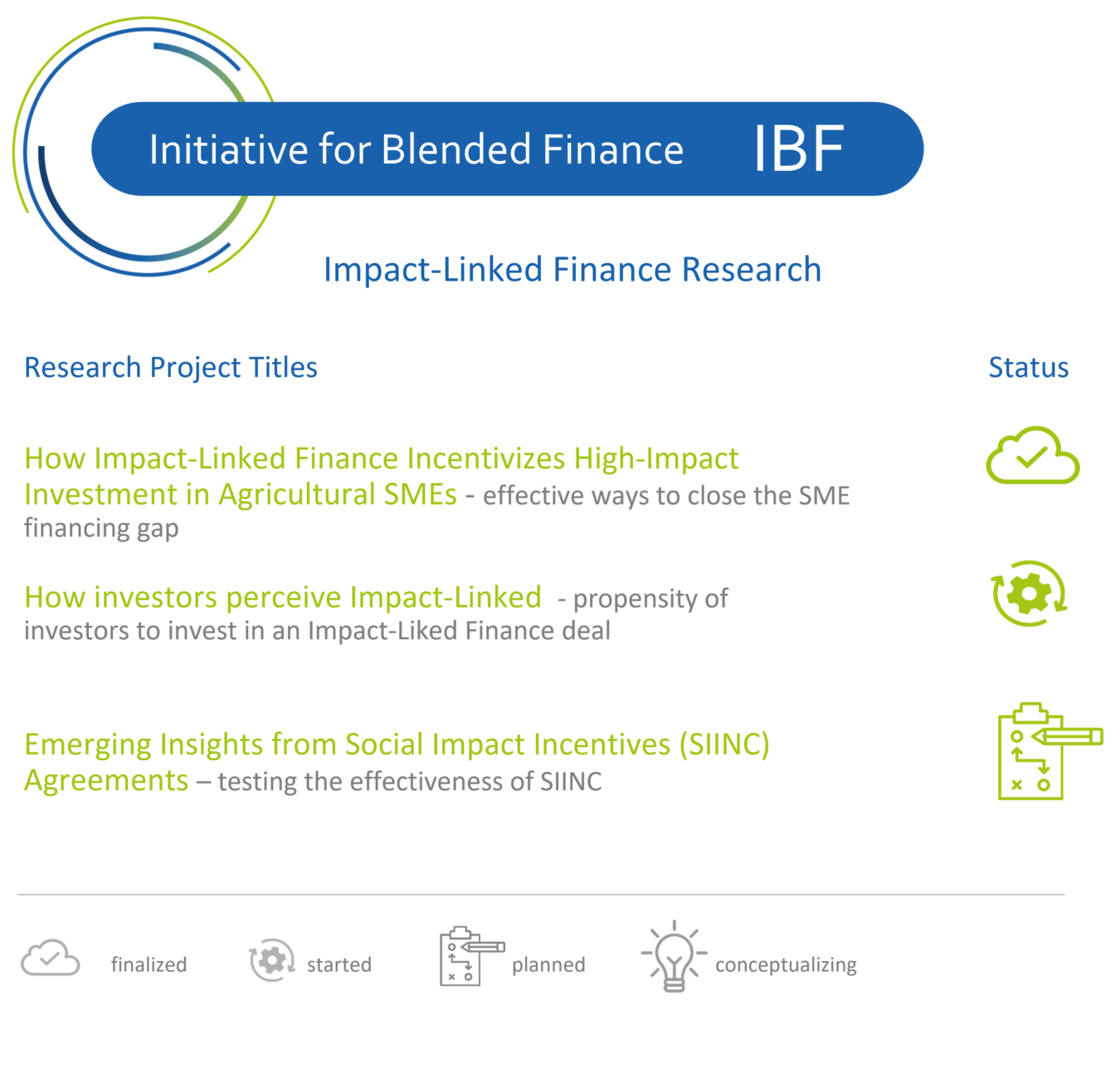

Research agenda

«Is Impact-Linked Finance effective?»

Blended finance is a powerful tool in scaling solutions to some of the most intractable challenges that the world faces today. Impact-Linked Finance, a new concept developed and introduced by our practice partners Roots of Impact and the Swiss Agency for Development and Cooperation, is a promising sub-set of blended finance. That said, it should not be seen as a panacea. Impact-Linked Finance has its place in the practitioner’s toolbox – alongside other blended finance as well as traditional forms of financing the SDGs -, but it is still a young and innovative practice.

This is why IBF practice partner Roots of Impact has launched a research agenda to ensure that rhetoric meets reality. By collaborating with top implementing partners, research centers, and universities across the globe, this research agenda seeks to produce high-quality information about if, how and why Impact-Linked Finance works. Ultimately, a transparent accounting of the strengths and limitations of Impact-Linked Finance will furnish blended finance actors with the information they need to decide when and how to implement it. It will also support them with the necessary evidence as they advocate for this fast-growing tool.

To learn more, read on the individual projects below and find their results in the relevant research reports. As the projects close, we will share these independent reports here and hope to inspire more blended finance actors with innovative and effective approaches.