Blended Finance Knowledge Test

Would you like to better understand your results in our knowledge test? Please find the highest score answers and some explanations below. Or do you strive to dig deeper and increase your knowledge? Then we have some valuable, curated resources for you, too.

The «Right» Test Results

Our knowledge test is designed to inspire learning. If you haven’t reached the full score (i.e. 100% in all 5 categories), it doesn’t mean that your answers are necessarily wrong – they simply may not be fully right. Below we offer some wisdom as to why specific answers will reach full scores. In addition, we provide curated resources for each question that may enrich your learning.

Then, your next test will probably look like this:

I. Blended Finance Purpose

Question 1: What is the main goal of Blended Finance?

Highest score answer: «It’s a strategic approach to use development finance and philanthropic funds to mobilize private capital flows to emerging and frontier markets.»

Background: This is the widely accepted definition by OECD/WEF. As compared to the other potential answers in our test, it incorporates all main defining characteristics of Blended Finance: (1) the strategic approach, (2) the catalytic effect of public and philanthropic funds on private sector capital flows, and (3) emerging and frontier markets as the targets. Instead of (3), you could also say «to finance the Sustainable Development Goals» or «in sustainable development», as can be found in other, more recent definitions of Blended Finance. Convergence, the global network for Blended Finance, defines it with a slight twist: «Blended finance is the use of catalytic capital from public or philanthropic sources to increase private sector investment in sustainable development.»

Learn more about the essentials in this original Blended Finance Primer (by WEF & OECD)

Learn more about the essentials in this original Blended Finance Primer (by WEF & OECD)

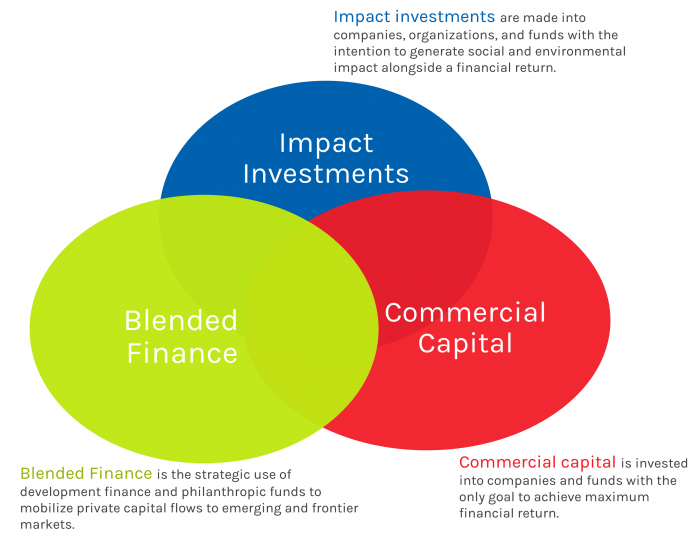

Question 2: How does Blended Finance differentiate from Impact Investing and Commercial Investing?

Highest score answer: «Blended Finance, Impact Investing and Commercial Investing are three different approaches that have distinct characteristics but also have overlaps in tackling specific development impact challenges»

Background: It is important to understand that Blended Finance is NOT a new investment discipline (nor an asset class) but a structuring approach. All three approaches in our question have their specific characteristics, areas of implementation and rationales that drive them. For SPECIFIC development impact challenges (more to these specifics in other test questions below), they can effectively work together and thus overlap.

Learn more by studying this graph (by Roots of Impact):

Question 3: What are the key characteristics of a Blended Finance transaction?

Highest score answer: «There are three key characteristics of every Blended Finance transaction: positive additionality, positive impact and positive financial return»

Background: Again, the other potential answers are not entirely wrong. Yet this one is the most comprehensive as it includes all three important characteristics. If a Blended Finance transaction provides no positive additionality, then other (traditional) approaches may be more effective or at least less resource-intensive and costly and thus more efficient. No doubt, a positive impact is a must in any meaningful development project. What is often misunderstood is that a Blended Finance transaction also needs to create a positive financial return. Otherwise, there is no chance to crowd in private sector capital.

Learn more by reading this insightful blog (by Joan Larrea, Convergence) as well as a great summary of challenges for development finance players (by Theodore Talbot, Center for Global Development)

II. Blended Finance Actors

Question 4: Who are the primary actors involved in Blended Finance transactions?

Highest score answer: «Private, philanthropic and public providers of capital plus the organizations and enterprises on the ground receiving the capital to implement the development impact project»

Background: Again, other answers in our test give some wisdom on this subject, but this one includes ALL primary actors. Sometimes, – with all the focus on mobilizing funds and capital -, we tend to forget about the (social) organizations and enterprises on the ground, – small, medium-sized or large -, who perform and implement the development project.

Learn more about such a social enterprise on the ground in this article or enjoy the entire Blended Finance case study (by Roots of Impact and Clínicas del Azúcar)

Learn more about such a social enterprise on the ground in this article or enjoy the entire Blended Finance case study (by Roots of Impact and Clínicas del Azúcar)

Question 5: What is THE essential Blended Finance feature that triggers more private capital flow to developing countries?

Highest score answer: «Improving the risk-return profile of transactions for private sector capital providers»

Background: Blended Finance has many great features and the other test answers are not entirely wrong. Yet the most important and therefore essential feature is that Blended Finance has two crucial effects on private capital providers: (1) it lowers the (real or perceived) risk of a transaction, and/or (2) it increases the (real or potential) financial return of a transaction. It is not rare that Blended Finance is mostly associated with effect number (1). Yet effect number (2) is equally important to achieve the much-needed mobilization of private capital to finance the SDGs. In essence, Blended Finance can create an attractive risk-return profile for private sector investors where there hasn’t been one before.

Learn more by reading this article on how to deal with an imperfect (investor) market (by Ashoka & Roots of Impact)

Question 6: How do the motives of public, philanthropic and private sector funders differ?

Highest score answer: «Public and philanthropic actors strive to achieve more effective and lasting impact with their funding, while private sector capital providers need to aim either for a pre-defined financial return for a given (or perceived) risk, or less risk for a given expected return»

Background: Blended Finance is about bringing together funders and capital providers with very different mindsets to achieve a common goal. Naturally, their individual motives will differ, but with the right kind of Blended Finance structure, a win-win-win situation is created. The answer above illustrates these different motives and also highlights the important effect of Blended Finance on the risk-return profile that private sector investors need to see in order to get engaged.

Learn more about the challenges of different impact actors to finance the SDGs and «move the needle» in this blogpost (by Sarah Bel, UNDP)

III. Blended Finance Instruments

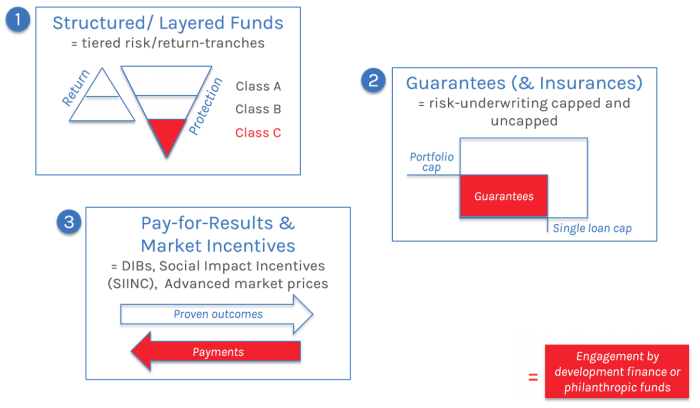

Question 7: What are the main types of Blended Finance solutions?

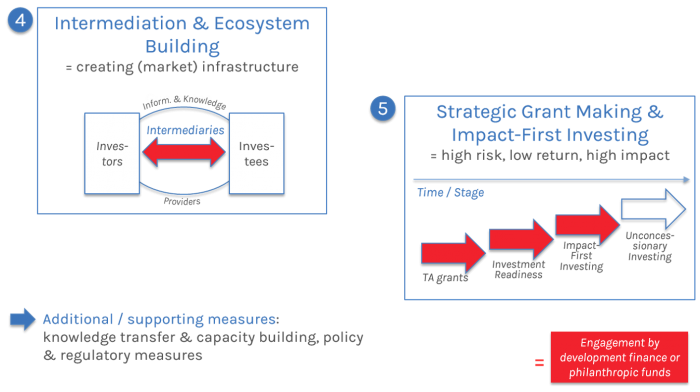

Highest score answer: «There are many ways for grants, guarantees and concessional capital to add value and catalyze. The main types are (1) structured & layered funds, (2) pay-for-results & market incentives, as well as (3) guarantees & insurances for risk underwriting. On top comes support for ecosystem-building or design & preparation of a project (e.g. Technical Assistance, Investment Readiness)»

Background: Typically, most donor organizations provide grants, loans and guarantees, sometimes with innovative features. Development Impact Bonds are increasingly known among development actors, too. Yet there is an entire range of smart Blended Finance solutions out there. The above answer lists all of these Blended Finance «archetypes» that are available to effectively catalyze private sector capital flows right now – and who knows, the list may be growing in the future.

Learn more by checking out the graphs below (by Roots of Impact). Another great resource is this highly insightful article on catalytic solutions (by Talbot & Barder, Center for Global Development)

Learn more by checking out the graphs below (by Roots of Impact). Another great resource is this highly insightful article on catalytic solutions (by Talbot & Barder, Center for Global Development)

Question 8: What is the core function of concessional capital in Blended Finance?

Highest score answer: «There are several value-adds, but the most important for Blended Finance are (a) a better risk-return ratio for private sector investors, and (b) less cost of capital for the transaction»

Background: This answer builds on the insights given in question 5 above, by illustrating the protection and/or return-enhancing effects on private sector investors. Cost of capital is another important function since a transaction could easily become too expensive without the involvement of concessional capital and thus fail to materialize.

Learn more about what concessional (impact) capital can do in this older, but still very relevant and pratice-driven blogpost (by Geeta Goel, Dell Foundation)

IV. Blended Finance Obstacles

Question 9: What is the biggest obstacle to increasing Blended Finance activities?

Highest score answer: «Understanding the different mind-sets of public, philanthropic and private sector funders and overcoming mentality gaps to enable effective collaboration»

Background: This answer may or may not be intuitive, but mentality gaps can be quite tough to overcome. For example, executives from development agencies and foundations often express that there is a tendency among peers to remain stuck in pilot projects instead of building self-sustaining and market-based solutions that are capable to scale their impact long-term. Private sector investors, on the other hand, frequently face criticism for seeking too high (i.e. risk-adjusted, market-rate) financial returns, for being too risk-averse or not serious enough about measuring and managing impact.

Learn more about typical mentality gaps in this blogpost on the first Impact Investment & Blended Finance Executive Program (by Social Finance Academy)

Question 10: When NOT to use Blended Finance?

Highest score answer: «When the project or solution doesn’t have a market-based model, isn’t scalable, lacks additionality and doesn’t provide evidence about its ability to create the intended impact as well as about the potential to become self-sustaining»

Background: This answer sums up – in a «negative» way – the essence of what has been described in the answers to questions 3 and 9 of our test. In all of these «no go» situations, a Blended Finance transaction simply cannot be impactful, additional, scalable and sustainable – and this is what it has to be.

Learn more about a positive example in this article about closing the agricultural financing gap with Blended Finance (by ImpactAlpha)

V. Blended Finance in Practice

Question 11: How many Blended Finance deals do you think have been closed world-wide to date?

Highest score answer: «More than 750»

Background: The latest deal tracker counts more than 1,100 blended finance deals globally by the end of 2023 (reported by Convergence) – with a tendency for growth but challenges ahead, too.

Learn more by reading The State of Blended Finance 2024 (by Convergence, 2024)

Question 12: What would you say is the typical deal size of a Blended Finance transaction?

Highest score answer: «There is a huge range, but typically the median is around 65 million.»

Background: Are you surprised? In the current stage of the Blended Finance market, data collection may not always be 100 % reliable and there are different sources for such data, but we recommend…:

…to investigate and stay up-to-date by visiting the Convergence webpage with the latest in deal sizes and other relevant market insights.